What Things to Avoid When Loaning Cash Now in Australia?

Easy money can be tempting, but borrowing irresponsibly can make things more complicated than they seem. What might start as a quick fix for a financial issue can quickly become a long-term problem. Many Australians turn to quick cash advances to get through tough times. While this service can be helpful, it’s crucial to approach it carefully.

In this discussion about borrowing cash now in Australia, we focus on strategies to help keep your finances stable and safe.\

Struggling With Money

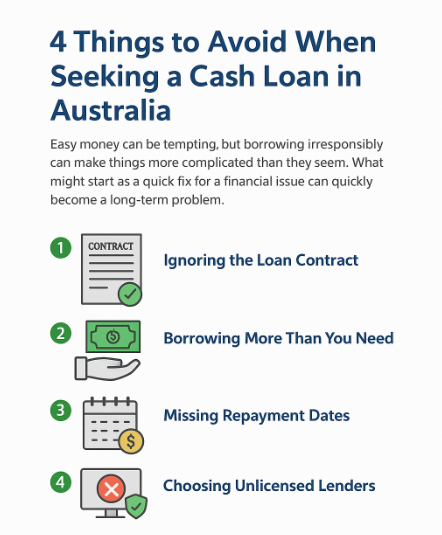

Four Things to Avoid When Seeking a Cash Loan in Australia

To ensure a short-term loan helps rather than harms your financial stability, avoid these common pitfalls:

- Ignoring the Loan Contract: Always read the fine print to understand the APR, fees, and penalties before signing.

- Borrowing More Than You Need: Avoid taking out more money than you can comfortably repay to prevent long-term debt cycles.

- Missing Repayment Dates: Treat repayment dates as non-negotiable to prevent late fees and negative credit impacts.

- Choosing Unlicensed Lenders: Verify the lender’s Australian Credit License and credibility to avoid scams and illegal fees for cash loans in Perth.

For transparency about fees and loan details, visit: Costs & Fees

Trust Our Commitment at Cash Now Perth!

At Cash Now Perth, lending money should be clear and supportive. We understand that when you need cash quickly, it can be stressful—so we make our process simple and transparent.

We guide you step by step through reviewing your financial information, evaluating your ability to repay, and explaining all fees and repayment plans clearly.

Our urgent cash loans in Perth are designed to help you make responsible and informed financial decisions.